October 12, 2022 at 8:57 AM Eastern

Bank of America’s Erica Tops 1 Billion Client Interactions, Now Nearly 1.5 Million Per Day

Since Launching in 2018, Erica® Has Helped Nearly 32 Million Bank of America Clients Manage Their Financial Lives

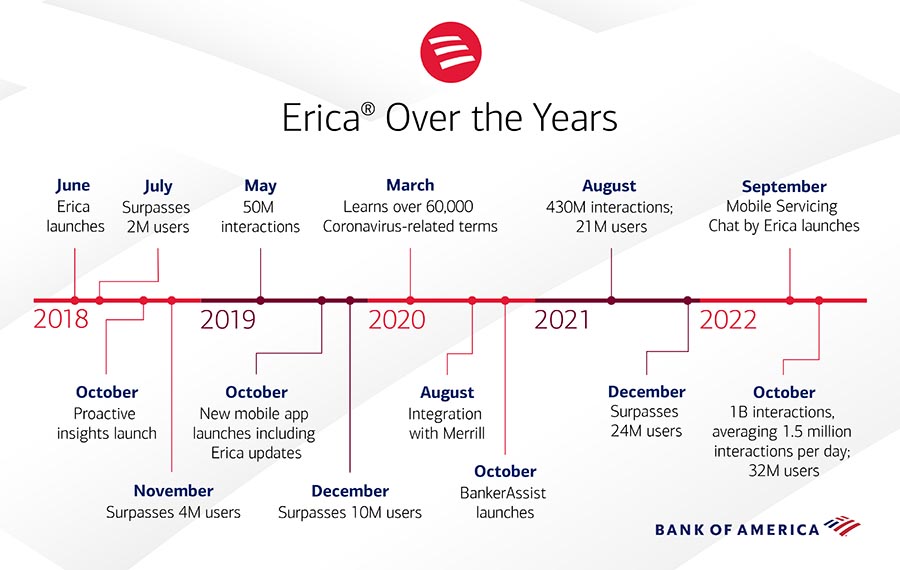

Erica, the most advanced and first widely available virtual financial assistant, has surpassed 1 billion interactions with Bank of America clients. The award-winning technology, powered by artificial intelligence (AI), officially launched in 2018 and has since helped nearly 32 million clients with their everyday financial needs.

“Erica is the definition of how Bank of America is delivering personalization and individualization at scale to our clients,” said David Tyrie, Chief Digital Officer and Head of Global Marketing at Bank of America. “We expect the second billion to come even more quickly as we continue to evolve Erica’s capabilities, providing clients with the shortest route to the answers they need about their financial lives.”

Since its launch, Erica has expanded to include new features and functionality:

“Bank of America has invested $3 billion or more on new technology initiatives each year for over a decade, including significant investments in AI that allow us to deliver a seamless user experience and industry-leading personalization for our clients banking online or on their mobile devices,” explains Aditya Bhasin, Chief Technology & Information Officer. “Our continued investment in Erica’s AI-powered capabilities enables us to quickly respond to voice, text chat or on-screen interactions from clients who need assistance with financial transactions, and to proactively deliver personalized insights and advice at key moments.”

As Erica’s capabilities have grown, so has its ability to help clients across their entire banking, lending and investing relationship with Bank of America, including Merrill Edge, Bank of America Private Bank and Benefits Online. Erica also supports Merrill clients through insights on portfolio performance, trading, investment balances, quotes and holdings and can help connect clients to a Merrill advisor. Additionally, bankers who support business clients at Bank of America use BankerAssist, an AI virtual assistant leveraging the underlying technology of Erica, to identify and close new opportunities, manage exposure and use real-time data to further client conversations.

Erica logo

Bank of America logo

Download the Bank of America app or visit the Bank of America website.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 67 million consumer and small business clients with approximately 4,000 retail financial centers, approximately 16,000 ATMs and award-winning digital banking with approximately 55 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America news, including dividend announcements and other important information, register for news email alerts.

Bank of America, Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Andy Aldridge, Bank of America

Phone: 1.980.387.0514

andrew.aldridge@bofa.com

October 12, 2022 at 8:57 AM Eastern

Bank of America’s Erica Tops 1 Billion Client Interactions, Now Nearly 1.5 Million Per Day

Since Launching in 2018, Erica® Has Helped Nearly 32 Million Bank of America Clients Manage Their Financial Lives

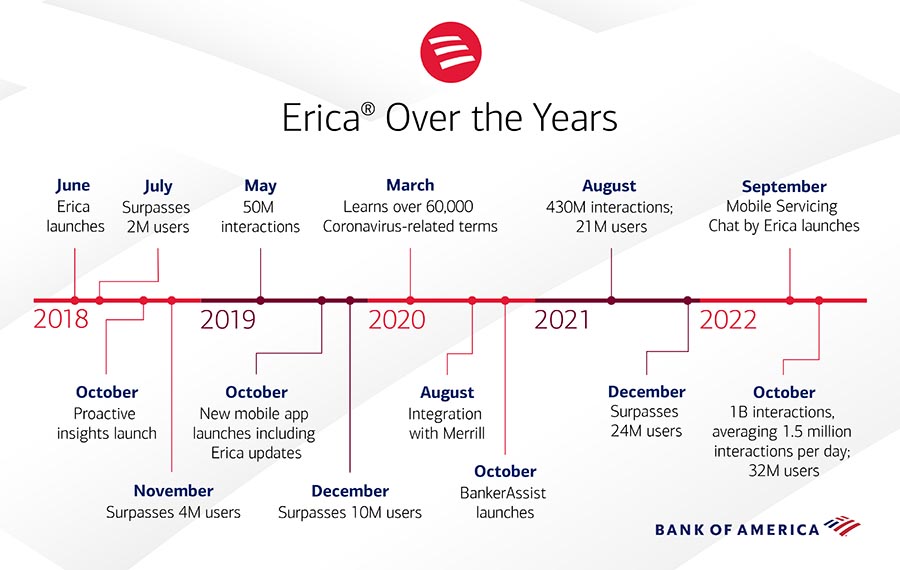

Erica, the most advanced and first widely available virtual financial assistant, has surpassed 1 billion interactions with Bank of America clients. The award-winning technology, powered by artificial intelligence (AI), officially launched in 2018 and has since helped nearly 32 million clients with their everyday financial needs.

“Erica is the definition of how Bank of America is delivering personalization and individualization at scale to our clients,” said David Tyrie, Chief Digital Officer and Head of Global Marketing at Bank of America. “We expect the second billion to come even more quickly as we continue to evolve Erica’s capabilities, providing clients with the shortest route to the answers they need about their financial lives.”

Since its launch, Erica has expanded to include new features and functionality:

“Bank of America has invested $3 billion or more on new technology initiatives each year for over a decade, including significant investments in AI that allow us to deliver a seamless user experience and industry-leading personalization for our clients banking online or on their mobile devices,” explains Aditya Bhasin, Chief Technology & Information Officer. “Our continued investment in Erica’s AI-powered capabilities enables us to quickly respond to voice, text chat or on-screen interactions from clients who need assistance with financial transactions, and to proactively deliver personalized insights and advice at key moments.”

As Erica’s capabilities have grown, so has its ability to help clients across their entire banking, lending and investing relationship with Bank of America, including Merrill Edge, Bank of America Private Bank and Benefits Online. Erica also supports Merrill clients through insights on portfolio performance, trading, investment balances, quotes and holdings and can help connect clients to a Merrill advisor. Additionally, bankers who support business clients at Bank of America use BankerAssist, an AI virtual assistant leveraging the underlying technology of Erica, to identify and close new opportunities, manage exposure and use real-time data to further client conversations.

Erica logo

Bank of America logo

Download the Bank of America app or visit the Bank of America website.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 67 million consumer and small business clients with approximately 4,000 retail financial centers, approximately 16,000 ATMs and award-winning digital banking with approximately 55 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America news, including dividend announcements and other important information, register for news email alerts.

Bank of America, Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Andy Aldridge, Bank of America

Phone: 1.980.387.0514

andrew.aldridge@bofa.com