March 29, 2023 at 3:00 PM Eastern

Over 10 Million BofA Clients Use Life Plan to Pursue Financial Goals Through Personalized Digital Experience

Available Within the Mobile App and Online, Life Plan Users Add More Than $55 Billion to BofA Accounts in Two Years

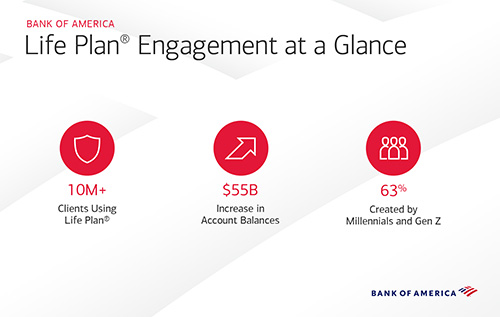

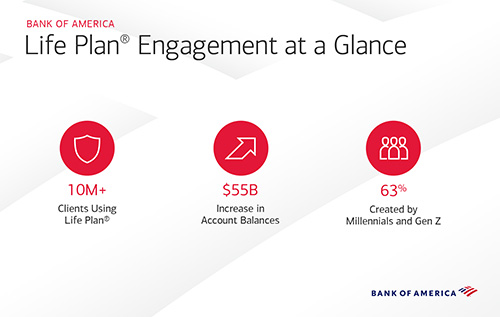

CHARLOTTE, NC – Bank of America today announced that more than 10 million clients have used Life Plan® since its launch in late 2020. Available within the Bank of America mobile app and online banking platform, Life Plan is a first-of-its-kind, personalized digital experience that enables clients to set and track near- and long-term goals based on their life priorities, and better understand and act on steps toward achieving them. Clients who have used Life Plan have added more than $55 billion to their Bank of America accounts, as of December 2022.

“Our clients appreciate having an easy, intuitive way to set, track and adjust their financial goals,” said David Tyrie, Chief Digital Officer and Chief Marketing Officer at Bank of America. “When we launched Life Plan more than two years ago, we did so to provide each client with personalized insights into their financial goals in our app and online, helping them keep track and giving them confidence for what’s ahead.”

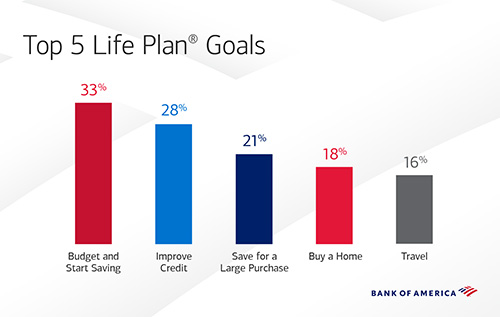

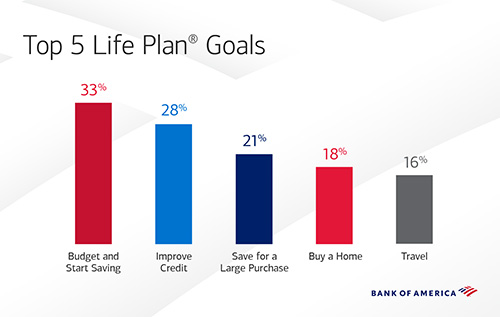

Currently, the top goals set by Life Plan users include: Budget and Start Saving (33% of users), Improve Credit (28%), Save for a Large Purchase (21%), Buy a Home (18%), and Travel (16%). This is the first time Travel has appeared as a top 5 goal in Life Plan. This aligns with data from the January Consumer Checkpoint from the Bank of America Institute which showed spending with airlines was up more than 20%, and up nearly 5% for lodging, both year over year.

Clients across all demographics are leveraging Life Plan to help them reach their financial goals and connect with financial professionals:

Life Plan’s 10 million user milestone comes at a time when clients’ use of digital capabilities are at record levels. More than 11.6 billion digital logins occurred in 2022 – a 10% year-over-year increase. In addition, last year, 33.5 million clients interacted with Erica®, the first widely available AI-driven virtual financial assistant, and more than 18.2 million Bank of America clients actively used Zelle.

More information on how Bank of America clients are engaging with digital banking is available in the bank’s quarterly Trends in Digital (PDF) fact sheet.

Download the Bank of America app or visit the Bank of America mobile webpage.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 56 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Andy Aldridge, Bank of America

Phone: 1.980.387.0514

andrew.aldridge@bofa.com

March 29, 2023 at 3:00 PM Eastern

Over 10 Million BofA Clients Use Life Plan to Pursue Financial Goals Through Personalized Digital Experience

Available Within the Mobile App and Online, Life Plan Users Add More Than $55 Billion to BofA Accounts in Two Years

CHARLOTTE, NC – Bank of America today announced that more than 10 million clients have used Life Plan® since its launch in late 2020. Available within the Bank of America mobile app and online banking platform, Life Plan is a first-of-its-kind, personalized digital experience that enables clients to set and track near- and long-term goals based on their life priorities, and better understand and act on steps toward achieving them. Clients who have used Life Plan have added more than $55 billion to their Bank of America accounts, as of December 2022.

“Our clients appreciate having an easy, intuitive way to set, track and adjust their financial goals,” said David Tyrie, Chief Digital Officer and Chief Marketing Officer at Bank of America. “When we launched Life Plan more than two years ago, we did so to provide each client with personalized insights into their financial goals in our app and online, helping them keep track and giving them confidence for what’s ahead.”

Currently, the top goals set by Life Plan users include: Budget and Start Saving (33% of users), Improve Credit (28%), Save for a Large Purchase (21%), Buy a Home (18%), and Travel (16%). This is the first time Travel has appeared as a top 5 goal in Life Plan. This aligns with data from the January Consumer Checkpoint from the Bank of America Institute which showed spending with airlines was up more than 20%, and up nearly 5% for lodging, both year over year.

Clients across all demographics are leveraging Life Plan to help them reach their financial goals and connect with financial professionals:

Life Plan’s 10 million user milestone comes at a time when clients’ use of digital capabilities are at record levels. More than 11.6 billion digital logins occurred in 2022 – a 10% year-over-year increase. In addition, last year, 33.5 million clients interacted with Erica®, the first widely available AI-driven virtual financial assistant, and more than 18.2 million Bank of America clients actively used Zelle.

More information on how Bank of America clients are engaging with digital banking is available in the bank’s quarterly Trends in Digital (PDF) fact sheet.

Download the Bank of America app or visit the Bank of America mobile webpage.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 56 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Andy Aldridge, Bank of America

Phone: 1.980.387.0514

andrew.aldridge@bofa.com