February 29, 2024 at 9:05 AM Eastern

BofA Delivers $7.1 Billion in Financing to Build 11,000 Housing Units

Community Development Banking Helps Clients, Communities Thrive Despite Challenging Economic Environment

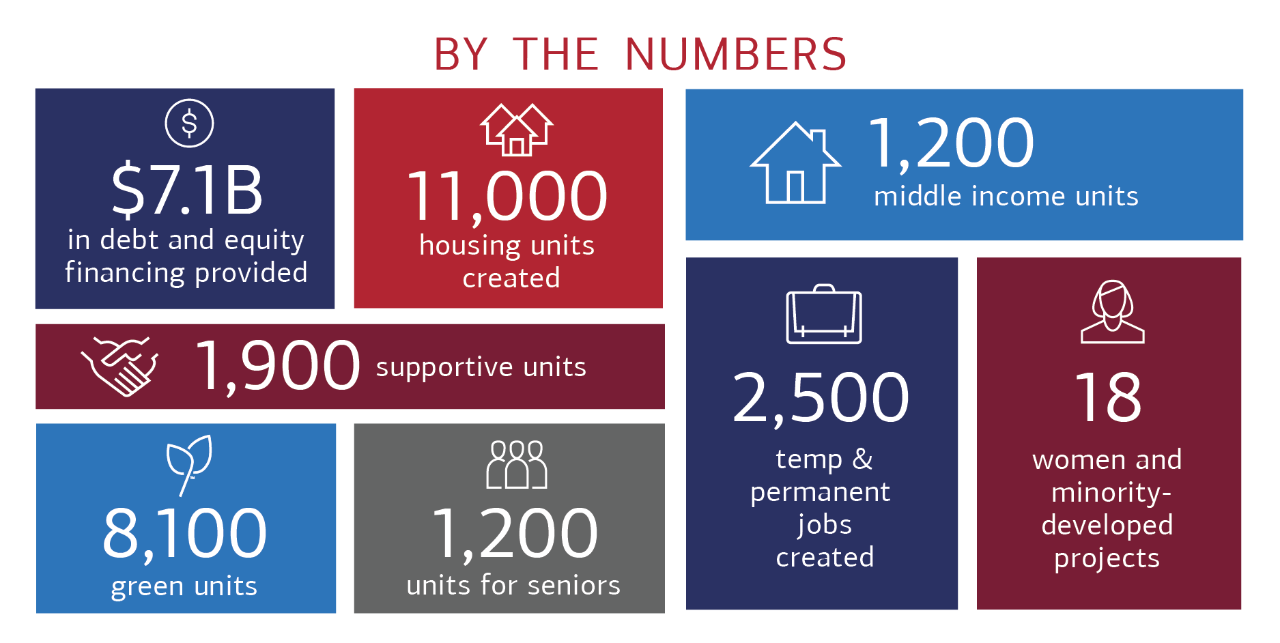

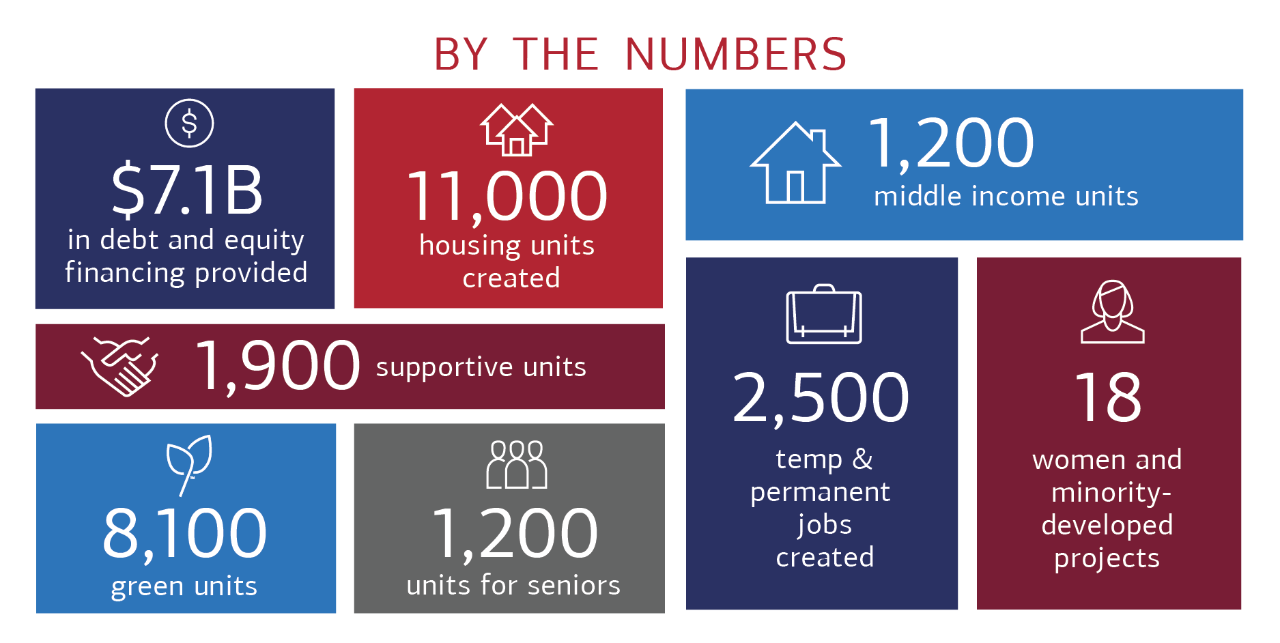

NEW YORK, NY – Bank of America Community Development Banking (CDB) today announced that it provided $7.1 billion in debt and equity financing last year to help build strong communities through affordable housing and economic opportunities across the United States. This financing helped create and preserve 11,000 housing units for individuals, families, seniors, veterans, the formerly homeless and those with special needs.

By the Numbers infographic long description

From left to right,

According to a 2023 report (PDF) by the Joint Center for Housing Studies at Harvard University, “millions of households are now priced out of homeownership, grappling with housing cost burdens, or lacking shelter altogether.”

“The need for affordable housing continues to grow. However, affordable housing developers face the same macroeconomic headwinds challenging other industries – higher interest rates, inflation and supply chain issues,” said Maria Barry, Community Development Banking national executive at Bank of America. “This requires our team to be creative, plan for all scenarios and advise our clients on how to mitigate risk and maximize results.”

Three factors that help drive the creation of affordable housing, include:

CDB is active in all 50 states. Since 2005, it has financed over 287,000 total housing units of which 247,000 are affordable.

Harnessing the strength and reach of Bank of America, our banking and markets businesses provided an additional $500 million in financing to support multi-family affordable housing. The bank also continued to support affordable and sustainable homeownership through its $15 billion Community Homeownership Commitment.

These efforts are part of the company’s commitment to deploying capital to address global issues outlined in the United Nations Sustainable Development Goals (SDGs).

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,800 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 57 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Anu Ahluwalia, Bank of America

Phone: 1.646.855.3375

anu.ahluwalia@bofa.com

February 29, 2024 at 9:05 AM Eastern

BofA Delivers $7.1 Billion in Financing to Build 11,000 Housing Units

Community Development Banking Helps Clients, Communities Thrive Despite Challenging Economic Environment

NEW YORK, NY – Bank of America Community Development Banking (CDB) today announced that it provided $7.1 billion in debt and equity financing last year to help build strong communities through affordable housing and economic opportunities across the United States. This financing helped create and preserve 11,000 housing units for individuals, families, seniors, veterans, the formerly homeless and those with special needs.

By the Numbers infographic long description

From left to right,

According to a 2023 report (PDF) by the Joint Center for Housing Studies at Harvard University, “millions of households are now priced out of homeownership, grappling with housing cost burdens, or lacking shelter altogether.”

“The need for affordable housing continues to grow. However, affordable housing developers face the same macroeconomic headwinds challenging other industries – higher interest rates, inflation and supply chain issues,” said Maria Barry, Community Development Banking national executive at Bank of America. “This requires our team to be creative, plan for all scenarios and advise our clients on how to mitigate risk and maximize results.”

Three factors that help drive the creation of affordable housing, include:

CDB is active in all 50 states. Since 2005, it has financed over 287,000 total housing units of which 247,000 are affordable.

Harnessing the strength and reach of Bank of America, our banking and markets businesses provided an additional $500 million in financing to support multi-family affordable housing. The bank also continued to support affordable and sustainable homeownership through its $15 billion Community Homeownership Commitment.

These efforts are part of the company’s commitment to deploying capital to address global issues outlined in the United Nations Sustainable Development Goals (SDGs).

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,800 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 57 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Anu Ahluwalia, Bank of America

Phone: 1.646.855.3375

anu.ahluwalia@bofa.com