August 31, 2020 at 9:00 AM Eastern

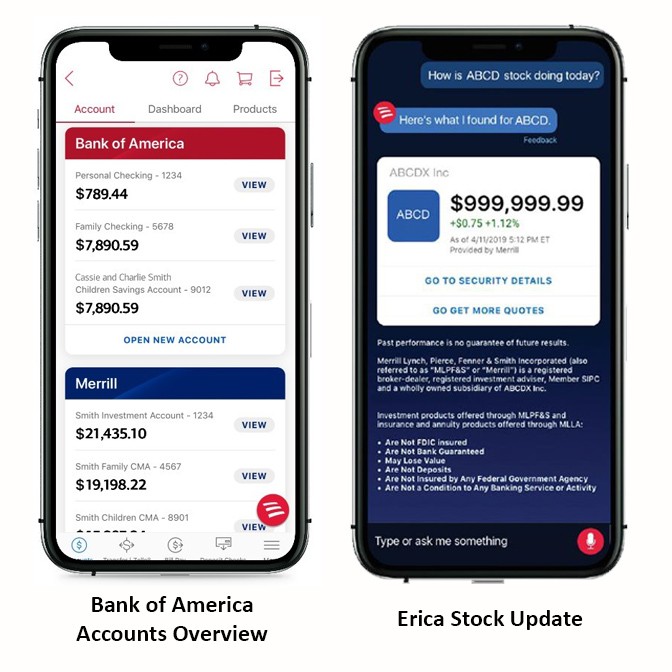

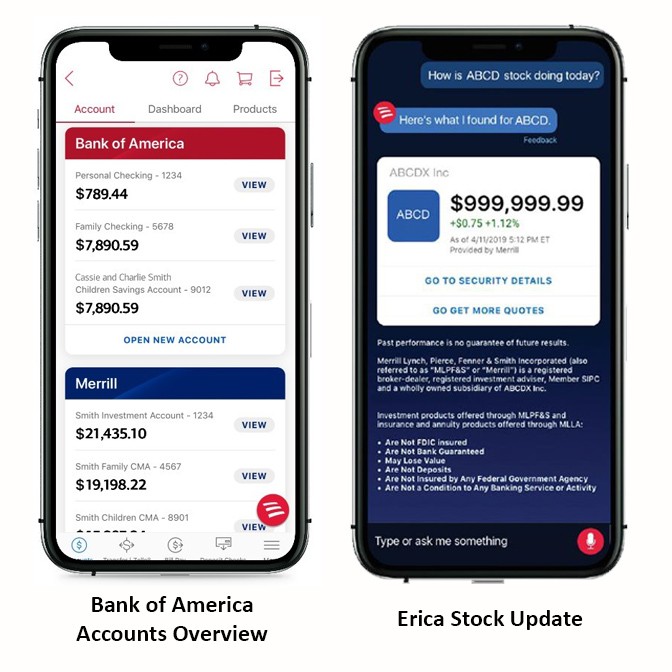

At a time when clients are engaging heavily through digital channels, Bank of America has announced enhancements to its mobile banking app as part of its ongoing commitment to delivering a personalized digital experience for clients’ banking, investing and lending needs. Within the mobile app, millions of Bank of America banking clients with either a Merrill investing or retirement relationship or a Bank of America Private Bank relationship can now benefit from convenient, easy and safe access to:

“We are focused on delivering a personalized digital experience that spans and supports the full breadth of each client’s relationship,” said David Tyrie, Bank of America head of Digital, Financial Center Strategy, and Advanced Client Solutions. “Each digital experience we develop for clients is founded on three principles: It should be in the client’s best interest; it should provide information and advice that is relevant and timely; and it should offer the client the choice of the next best step.”

Bank of America was one of the first banks to offer mobile banking and, more than a decade later, continues to lead the industry and make significant investments in this rapidly growing client channel. With more than 800 enhancements already made to its app in 2020, Bank of America is on pace to far exceed the 1,000 enhancements made in 2019.

“The way we deliver, develop and deploy technology is guided by asking ‘What is it that our clients want?’” said Aditya Bhasin, head of Consumer, Small Business and Wealth Management Technology at Bank of America. “This holistic, new digital experience is another step in our journey to help make our clients’ financial lives easier.”

Merrill clients can continue to leverage the MyMerrill app for more sophisticated tasks, including secure messaging with their Merrill advisor, document scanning, e-signatures and more.

In recent months, Bank of America has seen record levels of digital engagement. The company’s more than 40 million digital users are increasingly adopting and using key features, including:

Bank of America continues to receive extensive recognition for its digital capabilities and other innovative solutions, winning more than 100 awards this year within its Consumer Bank. Digital banking accolades this year include:

Bank of America’s award-winning digital banking platform is an evolving source of increased client engagement and satisfaction serving 40 million digital clients, including more than 30 million active mobile users. During the second quarter of 2020, digital clients logged into their accounts more than 2 billion times and used digital to make 133 million bill payments and book 665,000 appointments.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, including approximately 3,000 lending centers, 2,700 financial centers with a Consumer Investment Financial Solutions Advisor and approximately 2,100 business centers; approximately 16,900 ATMs; and award-winning digital banking with approximately 39 million active users, including approximately 30 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business owners through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America Corporation news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Andy Aldridge, Bank of America

Phone: 1.980.387.0514

andrew.aldridge@bofa.com

August 31, 2020 at 9:00 AM Eastern

Bank of America Offers Clients a More Complete, Personalized View of Their Financial Relationship Through Enhanced Mobile App ExperienceAt a time when clients are engaging heavily through digital channels, Bank of America has announced enhancements to its mobile banking app as part of its ongoing commitment to delivering a personalized digital experience for clients’ banking, investing and lending needs. Within the mobile app, millions of Bank of America banking clients with either a Merrill investing or retirement relationship or a Bank of America Private Bank relationship can now benefit from convenient, easy and safe access to:

“We are focused on delivering a personalized digital experience that spans and supports the full breadth of each client’s relationship,” said David Tyrie, Bank of America head of Digital, Financial Center Strategy, and Advanced Client Solutions. “Each digital experience we develop for clients is founded on three principles: It should be in the client’s best interest; it should provide information and advice that is relevant and timely; and it should offer the client the choice of the next best step.”

Bank of America was one of the first banks to offer mobile banking and, more than a decade later, continues to lead the industry and make significant investments in this rapidly growing client channel. With more than 800 enhancements already made to its app in 2020, Bank of America is on pace to far exceed the 1,000 enhancements made in 2019.

“The way we deliver, develop and deploy technology is guided by asking ‘What is it that our clients want?’” said Aditya Bhasin, head of Consumer, Small Business and Wealth Management Technology at Bank of America. “This holistic, new digital experience is another step in our journey to help make our clients’ financial lives easier.”

Merrill clients can continue to leverage the MyMerrill app for more sophisticated tasks, including secure messaging with their Merrill advisor, document scanning, e-signatures and more.

In recent months, Bank of America has seen record levels of digital engagement. The company’s more than 40 million digital users are increasingly adopting and using key features, including:

Bank of America continues to receive extensive recognition for its digital capabilities and other innovative solutions, winning more than 100 awards this year within its Consumer Bank. Digital banking accolades this year include:

Bank of America’s award-winning digital banking platform is an evolving source of increased client engagement and satisfaction serving 40 million digital clients, including more than 30 million active mobile users. During the second quarter of 2020, digital clients logged into their accounts more than 2 billion times and used digital to make 133 million bill payments and book 665,000 appointments.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, including approximately 3,000 lending centers, 2,700 financial centers with a Consumer Investment Financial Solutions Advisor and approximately 2,100 business centers; approximately 16,900 ATMs; and award-winning digital banking with approximately 39 million active users, including approximately 30 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business owners through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America Corporation news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Andy Aldridge, Bank of America

Phone: 1.980.387.0514

andrew.aldridge@bofa.com