December 4, 2023 at 9:05 AM Eastern

BofA Report Shows Fewer Prospective Homebuyers Willing to Wait for a Better Market Environment

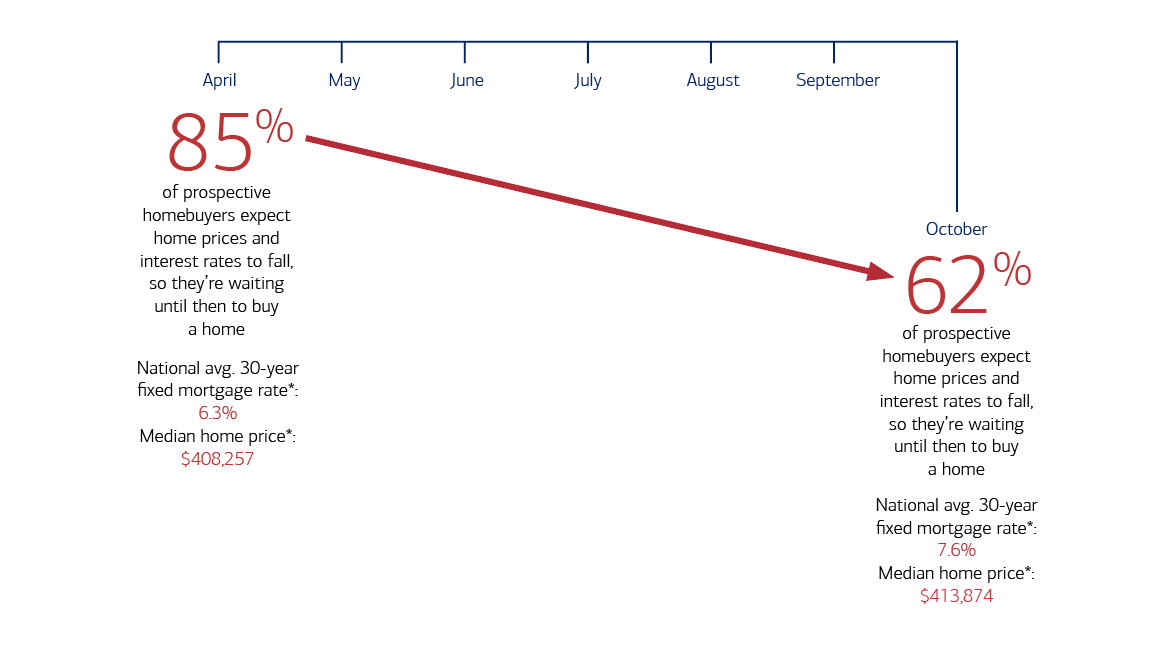

62% Willing to Wait for Prices and/or Rates to Fall Before Buying a Home, Down From 85% Just Six Months Ago

CHARLOTTE, NC – Prospective homebuyers’ patience may be waning, with fewer willing to wait until home prices or interest rates come down to purchase a home, according to new data from the Bank of America Homebuyer Insights Report (PDF). Today, 62% are willing to wait for prices and/or rates to fall before buying a home, down from 85% just six months ago. And they seem to be taking action: Sales of new single-family houses in September 2023 were a seasonally adjusted 759,000 – up from 679,00 sales in April 2023. [1]

“When it comes down to it, if buying a home is your goal and within your budget, the best time to buy is when you’re ready financially and you can find a home that fits your needs,” says Matt Vernon, head of consumer lending at Bank of America. “Even in the current interest rate environment, there are clear benefits to purchasing a home and beginning to build equity.”

This latest research also explores what buyers would be willing to forgo in order to buy sooner, and what would motivate current homeowners to sell.

Approximately 80% of outstanding U.S. mortgages have an interest rate below 5%. [2] This gives homeowners an incentive to stay put because the average 30-year fixed mortgage rate hit 8% in October of this year. [3] Younger people, Millennials in particular, are being hurt disproportionally by this trend, according to Bank of America Institute’s newly released Housing Morsel. The rate disparity is compressing the already limited supply of houses for sale, and begs the question: What does inspire homeowners to sell and free up inventory for would-be homebuyers in today’s environment?

Half of current homeowners say they’d be prompted to sell if their dream home became available (50%) and/or if they found a more affordable area (54%) – even if it meant paying a higher interest rate for a new mortgage. Additional motivations for some, but not as many, to move and give up their current mortgage rate include:

In fact, millions of people are moving to areas, including the Sun Belt, where they can afford to buy a home. Those surveyed say the following could or already has motivated them to move from one state to another:

Work-related reasons may also inspire homeowners to sell in this market, and work is a major driver of out-of-state moves. Those who have or would move to a new state for their careers are driven by increased job opportunities (57%), job requirements to relocate (29%) or the fact that they can work remotely and are no longer tied to an office (28%).

Overall, regional labor market dynamics and migration trends are closely correlated, according to Bank of America Institute. Internal Bank of America data found that of the 26 Metropolitan Statistical Areas (MSAs) tracked, Boston and Portland, OR, are more likely to see inward migration due to job changes and cities such as Austin, San Antonio, Las Vegas and Tampa saw the biggest population inflow during the third quarter. What is more, relocating workers seem to be getting bigger pay increases than those who stayed in the same MSA.

With inventory scarce, the Homebuyer Insights Report also explored how prospective buyers are adapting. The report found those surveyed would give up specific home features to increase their chances of finding a home in the year ahead. Notably, there are some differences in what older and younger generations are willing to sacrifice in order to buy a home.

Gen Z (15%) are less likely to give up space than baby boomers (40%). However, Gen Z (24%) would sooner compromise on location, including proximity to work, schools, and amenities than baby boomers (6%).

Across all generations, would-be buyers are most likely to give up the following if it increased the chances of finding a home to purchase:

This survey asked participants if they view homeownership as a top indicator of success. Here’s how homeownership stacked up against other key markers of success in life:

However, homeownership tops the list of how respondents define financial success (53%), according to those surveyed. Also important: saving enough money for an emergency fund (50%), paying down debt (45%) and being able to retire early (43%).

Nearly two-thirds (63%) of these homeowners said owning a home is one of their greatest personal achievements – more than raising a family (50%), being in a committed relationship (32%) and/or overcoming a significant challenge (25%).

Respondents continue to see homeownership as a reflection of significant achievement and driver of wealth creation that can help them build equity over time:

“There’s a clear desire for homeownership, but for some, it has become more challenging to achieve due to current market realities,” shares Vernon. “That’s why we are committed to offering affordable homeownership solutions, which include grants to help homebuyers with their down payments and closing costs, with no repayment required.”

Bank of America’s $15 billion Community Homeownership Commitment aims to help low- and moderate-income homebuyers across the country begin to build their personal wealth and family legacy through the power of homeownership. The program includes a combination of specially designed products, resources and expertise as well as one of the most generous grant programs in the industry. Bank of America offers up to $17,500 in combined down payment and closing costs grants and has already granted nearly $420 million to date, with 87% of those grants going to first-time homebuyers.

Sparks Research conducted a national online survey on behalf of Bank of America between September 25th and September 28th, 2023. A total of 1,000 surveys (500 homeowners / 500 renters) were completed by adults 18 years old or older, who make or share in household financial decisions, and who currently own a home/previously owned a home or plan to own a home in the future. Survey completions were monitored by gender and age and/or proper balancing. The margin of error for the total national quota of 1,000 surveys is +/- 3.1% at the 95% confidence level. The margin of error for homeowner and renter quotas of 500 surveys is +/- 4.4% at the 95% confidence level. Select questions allowed respondents to choose more than one answer, resulting in responses that may equate to more than 100 percent.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 57 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Susan Atran, Bank of America

Phone: 1.646.599.3300

susan.atran@bofa.com

[1] U.S. Census Bureau: Monthly New Residential Sales, September 2023 (PDF)

[2] Zillow: Rate-Locked Homeowners Nearly Twice as Likely to Not Consider Selling

[3] Redfin: Today's Mortgage Rates

To download the b-roll for editorial use, click on the video image and download from the video player.

To download files for editorial use, right click on the image and select 'Save as'.

Timeline chart showing:

April - 85% of perspective homebuyers expect home prices to fall, so they're waiting until then to buy a home. National average 30-year fixed mortgage rate: 6.3%. Median home price: $408,257.

May

June

July

August

September

October - 62% of perspective homebuyers expect home prices and interest rates to fall, so they're waiting until then to buy a home. National average 30-year fixed mortgage rate: 7.6%. Median home price: $413,874.

December 4, 2023 at 9:05 AM Eastern

BofA Report Shows Fewer Prospective Homebuyers Willing to Wait for a Better Market Environment

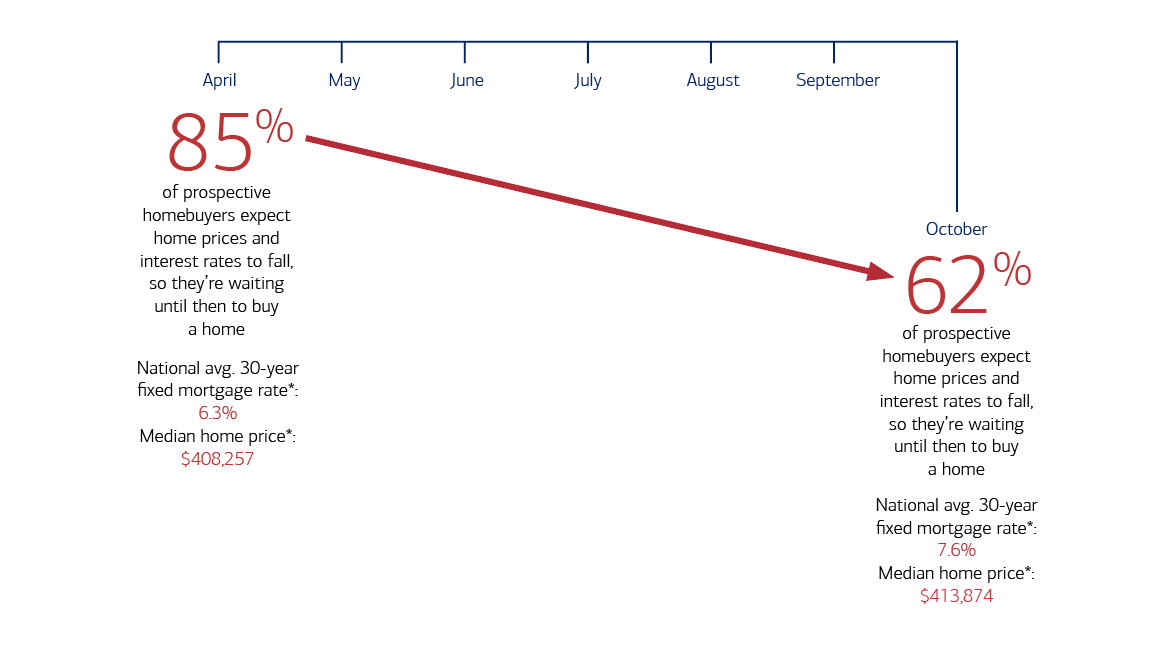

62% Willing to Wait for Prices and/or Rates to Fall Before Buying a Home, Down From 85% Just Six Months Ago

CHARLOTTE, NC – Prospective homebuyers’ patience may be waning, with fewer willing to wait until home prices or interest rates come down to purchase a home, according to new data from the Bank of America Homebuyer Insights Report (PDF). Today, 62% are willing to wait for prices and/or rates to fall before buying a home, down from 85% just six months ago. And they seem to be taking action: Sales of new single-family houses in September 2023 were a seasonally adjusted 759,000 – up from 679,00 sales in April 2023. [1]

“When it comes down to it, if buying a home is your goal and within your budget, the best time to buy is when you’re ready financially and you can find a home that fits your needs,” says Matt Vernon, head of consumer lending at Bank of America. “Even in the current interest rate environment, there are clear benefits to purchasing a home and beginning to build equity.”

This latest research also explores what buyers would be willing to forgo in order to buy sooner, and what would motivate current homeowners to sell.

Approximately 80% of outstanding U.S. mortgages have an interest rate below 5%. [2] This gives homeowners an incentive to stay put because the average 30-year fixed mortgage rate hit 8% in October of this year. [3] Younger people, Millennials in particular, are being hurt disproportionally by this trend, according to Bank of America Institute’s newly released Housing Morsel. The rate disparity is compressing the already limited supply of houses for sale, and begs the question: What does inspire homeowners to sell and free up inventory for would-be homebuyers in today’s environment?

Half of current homeowners say they’d be prompted to sell if their dream home became available (50%) and/or if they found a more affordable area (54%) – even if it meant paying a higher interest rate for a new mortgage. Additional motivations for some, but not as many, to move and give up their current mortgage rate include:

In fact, millions of people are moving to areas, including the Sun Belt, where they can afford to buy a home. Those surveyed say the following could or already has motivated them to move from one state to another:

Work-related reasons may also inspire homeowners to sell in this market, and work is a major driver of out-of-state moves. Those who have or would move to a new state for their careers are driven by increased job opportunities (57%), job requirements to relocate (29%) or the fact that they can work remotely and are no longer tied to an office (28%).

Overall, regional labor market dynamics and migration trends are closely correlated, according to Bank of America Institute. Internal Bank of America data found that of the 26 Metropolitan Statistical Areas (MSAs) tracked, Boston and Portland, OR, are more likely to see inward migration due to job changes and cities such as Austin, San Antonio, Las Vegas and Tampa saw the biggest population inflow during the third quarter. What is more, relocating workers seem to be getting bigger pay increases than those who stayed in the same MSA.

With inventory scarce, the Homebuyer Insights Report also explored how prospective buyers are adapting. The report found those surveyed would give up specific home features to increase their chances of finding a home in the year ahead. Notably, there are some differences in what older and younger generations are willing to sacrifice in order to buy a home.

Gen Z (15%) are less likely to give up space than baby boomers (40%). However, Gen Z (24%) would sooner compromise on location, including proximity to work, schools, and amenities than baby boomers (6%).

Across all generations, would-be buyers are most likely to give up the following if it increased the chances of finding a home to purchase:

This survey asked participants if they view homeownership as a top indicator of success. Here’s how homeownership stacked up against other key markers of success in life:

However, homeownership tops the list of how respondents define financial success (53%), according to those surveyed. Also important: saving enough money for an emergency fund (50%), paying down debt (45%) and being able to retire early (43%).

Nearly two-thirds (63%) of these homeowners said owning a home is one of their greatest personal achievements – more than raising a family (50%), being in a committed relationship (32%) and/or overcoming a significant challenge (25%).

Respondents continue to see homeownership as a reflection of significant achievement and driver of wealth creation that can help them build equity over time:

“There’s a clear desire for homeownership, but for some, it has become more challenging to achieve due to current market realities,” shares Vernon. “That’s why we are committed to offering affordable homeownership solutions, which include grants to help homebuyers with their down payments and closing costs, with no repayment required.”

Bank of America’s $15 billion Community Homeownership Commitment aims to help low- and moderate-income homebuyers across the country begin to build their personal wealth and family legacy through the power of homeownership. The program includes a combination of specially designed products, resources and expertise as well as one of the most generous grant programs in the industry. Bank of America offers up to $17,500 in combined down payment and closing costs grants and has already granted nearly $420 million to date, with 87% of those grants going to first-time homebuyers.

Sparks Research conducted a national online survey on behalf of Bank of America between September 25th and September 28th, 2023. A total of 1,000 surveys (500 homeowners / 500 renters) were completed by adults 18 years old or older, who make or share in household financial decisions, and who currently own a home/previously owned a home or plan to own a home in the future. Survey completions were monitored by gender and age and/or proper balancing. The margin of error for the total national quota of 1,000 surveys is +/- 3.1% at the 95% confidence level. The margin of error for homeowner and renter quotas of 500 surveys is +/- 4.4% at the 95% confidence level. Select questions allowed respondents to choose more than one answer, resulting in responses that may equate to more than 100 percent.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 57 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Susan Atran, Bank of America

Phone: 1.646.599.3300

susan.atran@bofa.com

[1] U.S. Census Bureau: Monthly New Residential Sales, September 2023 (PDF)

[2] Zillow: Rate-Locked Homeowners Nearly Twice as Likely to Not Consider Selling

[3] Redfin: Today's Mortgage Rates

To download the b-roll for editorial use, click on the video image and download from the video player.

To download files for editorial use, right click on the image and select 'Save as'.

Timeline chart showing:

April - 85% of perspective homebuyers expect home prices to fall, so they're waiting until then to buy a home. National average 30-year fixed mortgage rate: 6.3%. Median home price: $408,257.

May

June

July

August

September

October - 62% of perspective homebuyers expect home prices and interest rates to fall, so they're waiting until then to buy a home. National average 30-year fixed mortgage rate: 7.6%. Median home price: $413,874.