October 9, 2024 at 9:00 AM Eastern

BofA Study: Nearly 80% of U.S. Business Owners Anticipate Revenue Growth in the Coming Year

Majority of Women and Minority Business Owners Surveyed Plan to Expand Their Businesses Over the Next 12 Months

CHARLOTTE, NC – Nearly four out of five (78%) small and mid-sized business owners anticipate revenue growth in the next 12 months. This level of confidence spans most business owners, with 76% of women, 82% of Hispanic-Latino, 84% of Black/African American and 83% of Asian American and Pacific Islander (AAPI) entrepreneurs anticipating revenue growth in the year ahead.

This is according to the 2024 Bank of America Women & Minority Business Owner Spotlight (PDF), published in partnership with Bank of America Institute. The survey of more than 2,000 small and mid-size business owners across the country explores sentiments about business outlook, access to capital, how they manage their employees, and how they interact with their community. This annual survey samples a general population of small and mid-sized business owners and includes specific insights into the perspectives of women, Hispanic-Latino, Black/African American and AAPI business owners.

“These businesses are the heart of the U.S. economy and business owners are expecting to increase their revenue in the coming year, despite continued concerns around inflation,” said Raul Anaya, president and co-head of Business Banking for Bank of America. “Many also plan to hire and invest in employee education, such as training and mentoring programs, as they prioritize their labor force and explore opportunities for growth.”

Business owners across all surveyed cohorts are cautiously optimistic that economies will improve over the next 12 months. Nationwide, 66% believe the local economy will improve, 60% believe the national economy will improve, and 57% believe the global economy will improve.

However, data suggests that smaller employers are less optimistic. Some 78% of mid-sized business owners [1] plan to expand and 61% plan to hire over the next year, while just 50% of small business owners [2] plan to expand and 39% plan to hire.

“Finding quality labor is one challenge facing many smaller firms, though employment growth is still strong, and our clients continue to be optimistic about staffing,” said Sharon Miller, president and co-head of Business Banking for Bank of America. “In the year ahead, they are looking to invest in their employees and utilize technology to bolster their hiring and improve client experiences.”

This divergence across business size aligns with Bank of America Institute’s September Small Business Checkpoint, which found lower confidence among smaller businesses compared to their larger counterparts. However, consistent with the survey finding that business owners are continuing to expand their businesses, the Small Business Checkpoint showed continued payroll growth and elevated hiring demand compared to 2019.

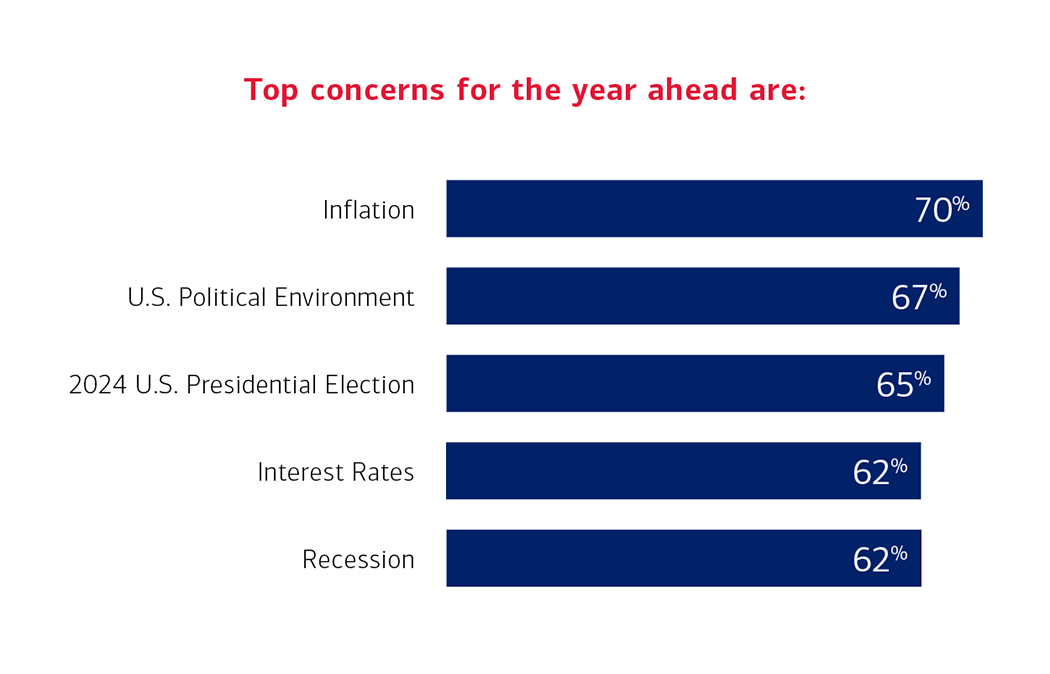

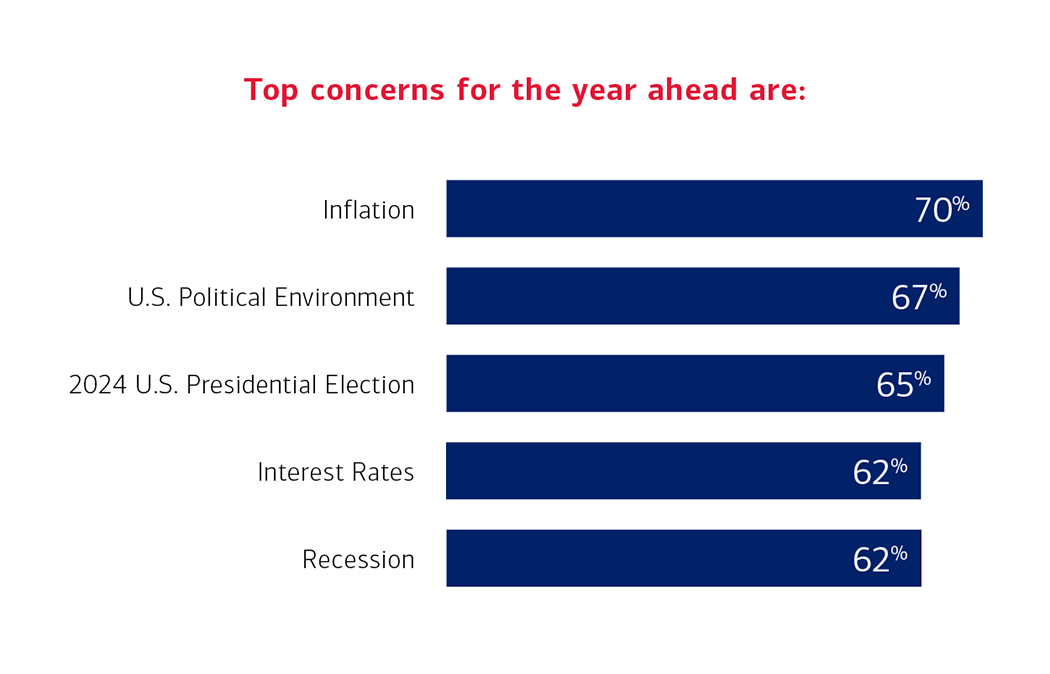

Beyond hiring concerns, business owners across the country identified inflation and the political environment as top issues.

Over half (57%) of women business owners plan to expand their business in the year ahead. Their expansion strategies include:

Even with expansion goals in mind, 54% of women business owners increased their prioritization of their work-life balance over the past year. Women measure their work-life balance through having time to take care of personal responsibilities (71%) and feeling like they have enough energy to accomplish everything they want to (62%). As they balance their life priorities and business needs, most women feel they have the support they need to grow their business.

Hispanic-Latino business owners report strong confidence in the economy. Of these business owners, 76% expect the national economy to improve over the next year and plan to obtain funding (94%) and hire more employees (64%). Some 78% plan to expand their businesses over the coming year.

Esmeralda Hernandez, founder and CEO of Los Angeles-based cosmetics company Beauty Creations said that conditions for her business reflect these sentiments. “We continued to scale across key growth measures this year – revenue, hiring, client growth and physical expansion – and remain confident this momentum will continue into the new year. Despite some lingering uncertainty about inflationary costs and other economic pressures, we feel strongly about our growth projections. It’s a good time for our business overall,” she said.

Labor challenges are also top of mind for Hispanic-Latino business owners, with 81% of owners surveyed saying they are currently impacting their business. As a result of these challenges, they are:

To learn more about the opportunities and struggles for Hispanic-Latino business owners, see our 2024 Hispanic-Latino Business Owner Spotlight (PDF).

Black/African American business owners are optimistic about their success in the year ahead and report strong business and economic outlooks. Over the coming year, 77% plan to expand, and 94% plan to obtain funding for their businesses.

Black/African American entrepreneurs are prioritizing personalized customer interactions, with 70% noting the importance of this tactic to attract and retain customers. Ninety-two percent of those surveyed are also adjusting their marketing strategies and approaches, such as:

AAPI business owners also hold strong expectations for economic growth and success in the coming year:

AAPI business owners also plan to seek capital and plan to improve their workforce stability in the year ahead. Sixty percent plan to hire more employees and many are utilizing technology and AI tools to assist their hiring efforts.

Ipsos conducted the Women & Minority Business Owner Spotlight survey online between August 7 and August 21, 2024, using a pre-recruited online sample of small and mid-sized business owners. Ipsos contacted a national sample of 752 small business owners in the United States with annual revenue between $100,000 and $4,999,999 and employing between two and 99 employees, as well as 406 interviews of Hispanic-Latino small business owners, 269 interviews of Black/African American small business owners, and 160 interviews of Asian American Pacific Islander (AAPI) small business owners. Ipsos also interviewed a national sample of 323 mid-sized business owners in the United States with annual revenue between $5,000,000 and $49,999,999 and employing between two and 499 employees, along with 200 interviews of Hispanic-Latino mid-sized business owners, 159 interviews of Black/African American mid-sized business owners, and 55 interviews of AAPI mid-sized business owners. The final results for the national segments, the demographic segments and combined samples of the small and mid-sized business owners were weighted to national benchmark standards for size, revenue and region.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,800 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 58 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Susan Atran, Bank of America

Phone: 1.646.743.0791

susan.atran@bofa.com

Anu Ahluwalia, Bank of America

Phone: 1.646.855.3375

anu.ahluwalia@bofa.com

To download files for editorial use, visit Small Business in our media content library.

October 9, 2024 at 9:00 AM Eastern

BofA Study: Nearly 80% of U.S. Business Owners Anticipate Revenue Growth in the Coming Year

Majority of Women and Minority Business Owners Surveyed Plan to Expand Their Businesses Over the Next 12 Months

CHARLOTTE, NC – Nearly four out of five (78%) small and mid-sized business owners anticipate revenue growth in the next 12 months. This level of confidence spans most business owners, with 76% of women, 82% of Hispanic-Latino, 84% of Black/African American and 83% of Asian American and Pacific Islander (AAPI) entrepreneurs anticipating revenue growth in the year ahead.

This is according to the 2024 Bank of America Women & Minority Business Owner Spotlight (PDF), published in partnership with Bank of America Institute. The survey of more than 2,000 small and mid-size business owners across the country explores sentiments about business outlook, access to capital, how they manage their employees, and how they interact with their community. This annual survey samples a general population of small and mid-sized business owners and includes specific insights into the perspectives of women, Hispanic-Latino, Black/African American and AAPI business owners.

“These businesses are the heart of the U.S. economy and business owners are expecting to increase their revenue in the coming year, despite continued concerns around inflation,” said Raul Anaya, president and co-head of Business Banking for Bank of America. “Many also plan to hire and invest in employee education, such as training and mentoring programs, as they prioritize their labor force and explore opportunities for growth.”

Business owners across all surveyed cohorts are cautiously optimistic that economies will improve over the next 12 months. Nationwide, 66% believe the local economy will improve, 60% believe the national economy will improve, and 57% believe the global economy will improve.

However, data suggests that smaller employers are less optimistic. Some 78% of mid-sized business owners [1] plan to expand and 61% plan to hire over the next year, while just 50% of small business owners [2] plan to expand and 39% plan to hire.

“Finding quality labor is one challenge facing many smaller firms, though employment growth is still strong, and our clients continue to be optimistic about staffing,” said Sharon Miller, president and co-head of Business Banking for Bank of America. “In the year ahead, they are looking to invest in their employees and utilize technology to bolster their hiring and improve client experiences.”

This divergence across business size aligns with Bank of America Institute’s September Small Business Checkpoint, which found lower confidence among smaller businesses compared to their larger counterparts. However, consistent with the survey finding that business owners are continuing to expand their businesses, the Small Business Checkpoint showed continued payroll growth and elevated hiring demand compared to 2019.

Beyond hiring concerns, business owners across the country identified inflation and the political environment as top issues.

Over half (57%) of women business owners plan to expand their business in the year ahead. Their expansion strategies include:

Even with expansion goals in mind, 54% of women business owners increased their prioritization of their work-life balance over the past year. Women measure their work-life balance through having time to take care of personal responsibilities (71%) and feeling like they have enough energy to accomplish everything they want to (62%). As they balance their life priorities and business needs, most women feel they have the support they need to grow their business.

Hispanic-Latino business owners report strong confidence in the economy. Of these business owners, 76% expect the national economy to improve over the next year and plan to obtain funding (94%) and hire more employees (64%). Some 78% plan to expand their businesses over the coming year.

Esmeralda Hernandez, founder and CEO of Los Angeles-based cosmetics company Beauty Creations said that conditions for her business reflect these sentiments. “We continued to scale across key growth measures this year – revenue, hiring, client growth and physical expansion – and remain confident this momentum will continue into the new year. Despite some lingering uncertainty about inflationary costs and other economic pressures, we feel strongly about our growth projections. It’s a good time for our business overall,” she said.

Labor challenges are also top of mind for Hispanic-Latino business owners, with 81% of owners surveyed saying they are currently impacting their business. As a result of these challenges, they are:

To learn more about the opportunities and struggles for Hispanic-Latino business owners, see our 2024 Hispanic-Latino Business Owner Spotlight (PDF).

Black/African American business owners are optimistic about their success in the year ahead and report strong business and economic outlooks. Over the coming year, 77% plan to expand, and 94% plan to obtain funding for their businesses.

Black/African American entrepreneurs are prioritizing personalized customer interactions, with 70% noting the importance of this tactic to attract and retain customers. Ninety-two percent of those surveyed are also adjusting their marketing strategies and approaches, such as:

AAPI business owners also hold strong expectations for economic growth and success in the coming year:

AAPI business owners also plan to seek capital and plan to improve their workforce stability in the year ahead. Sixty percent plan to hire more employees and many are utilizing technology and AI tools to assist their hiring efforts.

Ipsos conducted the Women & Minority Business Owner Spotlight survey online between August 7 and August 21, 2024, using a pre-recruited online sample of small and mid-sized business owners. Ipsos contacted a national sample of 752 small business owners in the United States with annual revenue between $100,000 and $4,999,999 and employing between two and 99 employees, as well as 406 interviews of Hispanic-Latino small business owners, 269 interviews of Black/African American small business owners, and 160 interviews of Asian American Pacific Islander (AAPI) small business owners. Ipsos also interviewed a national sample of 323 mid-sized business owners in the United States with annual revenue between $5,000,000 and $49,999,999 and employing between two and 499 employees, along with 200 interviews of Hispanic-Latino mid-sized business owners, 159 interviews of Black/African American mid-sized business owners, and 55 interviews of AAPI mid-sized business owners. The final results for the national segments, the demographic segments and combined samples of the small and mid-sized business owners were weighted to national benchmark standards for size, revenue and region.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,800 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 58 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Susan Atran, Bank of America

Phone: 1.646.743.0791

susan.atran@bofa.com

Anu Ahluwalia, Bank of America

Phone: 1.646.855.3375

anu.ahluwalia@bofa.com

To download files for editorial use, visit Small Business in our media content library.